2019 Singapore Fintech Festival, a global fintech event organized by Monetary Authority of Singapore (MAS), in partnership with the Association of Banks in Singapore, and sponsored by AMTD Group, Deloitte and Prudential, was successfully held from November 11th to November 15th. This Fintech Festival attracted over 60,000 government officials, representatives of regulatory agencies, representatives of financial institutions, technology innovation companies, and institutional investors from more than 100 countries around the world to gather in Singapore, and to discuss technological innovation and development. Singapore Fintech Festival is the largest and most attended global fintech event in the world. AMTD Group has been the biggest supporter and grand sponsor to the Singapore Fintech Festival for three consecutive years.

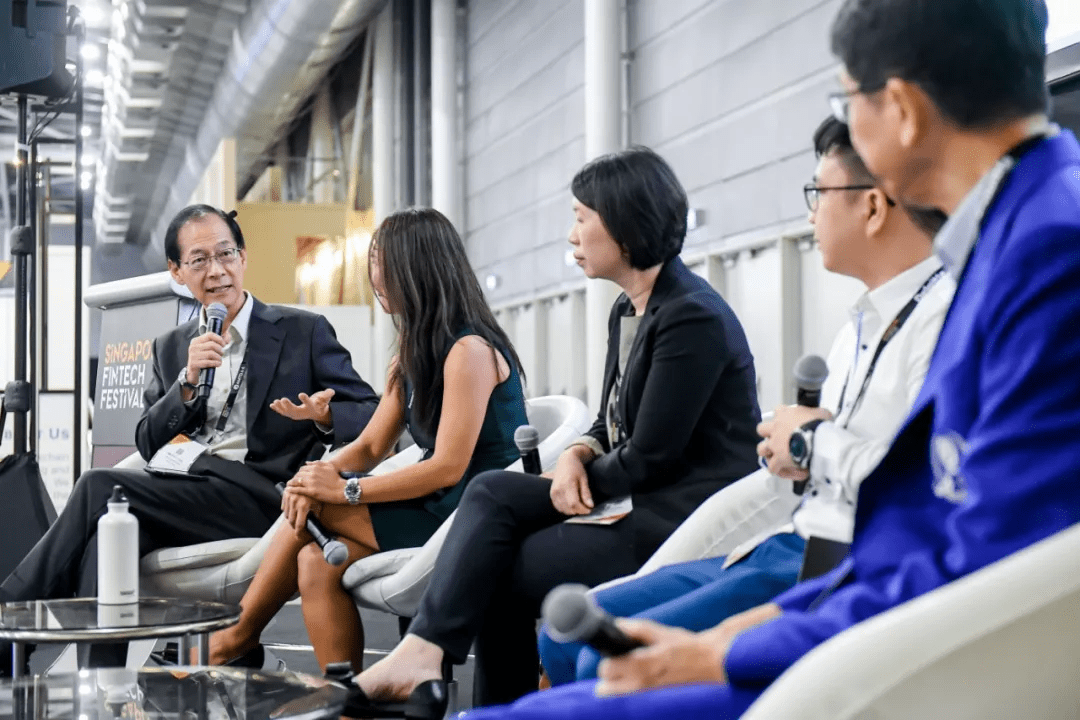

On 11th November, at the Conservation Stage of the Singapore Fintech Festival, Prof. Timothy Tong, CEO of AMTD Foundation and Chairman of the Council, Hong Kong Laureate Forum and Former President of The Hong Kong Polytechnic University, hosted a panel talk on Cultivation of Fintech Talents in Singapore and Asia. Dr. Frederic Lau, Vice Chairman of AMTD Group and Chief Executive of Airstar Bank, Yap Aye Wee, Senior Vice President and Head of Learning and Development and Head of Human Resources at OCBC Bank, Dr. Pun Chi Seng, Head of the Fintech Graduate Department of Nanyang Technological University in Singapore, and Tan Ching Ching, Deputy Director of Fintech Department of Ngee Ann Polytechnic, shared their views.

Talent is an important driving force for continued development in various industries, especially in Fintech industry, which is relatively newly-developing. However, recruiting the right talents can be challenging for Fintech companies. For the job market of Fintech talents, Dr. Frederic Lau, Vice Chairman of AMTD Group and Chief Executive of Airstar Bank, said that Airstar Bank, co-launched and co-founded by AMTD Group and Xiaomi Group, was awarded one of eight virtual bank licenses issued by the Hong Kong Monetary Authority on 9th May 2019. Xiaomi is the world well-known technology company with strong technical background. In the preparation process of Airstar Bank, about 30 to 40 top Internet scientists from Xiaomi provided technical support for the bank, while AMTD Group, as the largest private independent investment Bank in Asia, provided professional financial experts for financial support. The recruitment of interdisciplinary talents shows the great demand for Fintech talents in the market. In addition to professional skills, Dr. Frederic Lau added that interdisciplinary talents should also equip with business insights and presentation skills in current society to effectively communicate with customers and senior management, which can be of great help in business applications.

It has become an urgent matter for all Fintech companies to recruit and train compound talents who have the ability of scientific research and understand the application in the financial field. Yap Aye Wee, Senior Vice President and Head of Learning and Development and Head of Human Resources at OCBC Bank, used her definition of talent as a starting point to further discuss how to attract the talent from inside and outside. Yap Aye Wee said there are three different stages of talent: mastering basic professional knowledge and skills in the first stage; mastering business skills in the second stage, that is, to have the ability to grasp valuable opportunities and to sustainably create value; and having the ability to adapt to industry changes and continue to learn in third stage. At present, there is a shortage of talents in the banking industry. In addition to the continuous recruitment of new high-quality talents, internal employees will also become the key training targets. OCBC has focused its efforts and resources on retraining internal staff to transform existing staff into interdisciplinary talents in Fintech field.

Tan Ching Ching, Deputy Director of Fintech Department of Ngee Ann Polytechnic, explained the requirements and aims of current Fintech talent development through introduction to her department. In 2016, MAS together with five Singapore polytechnic universities (Nanyang Technological University, Ngee Ann Polytechnic, Republic Polytechnic, Singapore Polytechnic and Temasek Polytechnic) jointly created a new teaching syllabus for Fintech courses. Ngee Ann Polytechnic initiated to form PolyFintech 100, League of top polytechnic universities, inviting practitioners in Fintech industry as consultant and providing programs such as internship, projects research and competitions. The purpose is to come into contact with the industry forefront development and provide more advanced skills training for college students to help them obtain more job opportunities in Fintech industry. Increasing communication with practitioners in Fintech industry allows students to get first-hand feedback and suggestions, to develop their skills in accordance with the requirements in Fintech industry, and to face and attempt to solve the real problems in the industry. Ngee Ann Polytechnic also offers adult re-education for working financial professionals.

Dr. Pun Chi Seng, Head of the Fintech Graduate Department of Nanyang Technological University in Singapore, said NTU offers a variety of new projects, such as artificial intelligence and science data management. At the same time, students can also independently choose double degree to explore their own interest, while NTU also provides students with internships and project research. In addition to the undergraduate program, NTU launched new Fintech program for graduate last year, which serves as a joint venture among Business School and Science School and Engineering School, gathering powerful and diversified faculty to share cutting-edge ideas and technologies with students. The program is divided into full-time and part-time programs, not only for fresh graduates, but also for those who already have work experience and need retraining. Compared with traditional pure finance or pure engineering projects, Fintech program in NTU covers data science, artificial intelligence and information technology with a focus on disruptive technologies in the financial sector, including robo-consulting and blockchain. Meanwhile, the project is subdivided into two branches: artificial intelligence, operation and compliance.