The panel was moderated by Dr. Dicky Shek, Professor of Practice (Management Information Systems), Department of Management and Marketing, The Hong Kong Polytechnic University (PolyU). Other panelists included: Dr. Henry Chan, Associate Professor & Associate Head, Department of Computing, PolyU; Dr. Steven Wei, Deputy Director, AMTD Fintech Centre of PolyU Faculty of Business, PolyU; Mr. Ken Lo, Deputy Chairman, BC Technology Group; Dr. Derek Chung, Veteran Banker, Life Member of DBA Alumni Association, PolyU.

The panelists agreed that, Fintech and digital transformation are an irreversible trend in the Greater Bay Area. Fintech has a broader coverage beyond financial industry – it brings opportunities to every sector. Currently, there is a global talent shortage due to the fast-expanding Fintech needs, so companies and governments should collaborate to nurture more Fintech talents. They all believed that Hong Kong will remain to be an international financial hub and expected to see synergies with Shenzhen, the international innovation center.

Ms. Michelle Li added that, AMTD aims to combine the capabilities of all its subsidiaries to build a one-stop cross-border digital financial services platform, covering the whole digitalization journey of customers. She also addressed that AMTD has launched several Fintech leadership programs to grow more talents, e.g., AMTD-Xiaomi-SMU-ISS Digital Finance Leadership Programme, and collaborated with universities to empower talent incubation. AMTD collaborated with The Hong Kong Polytechnic University to establish the “AMTD Fintech Centre of PolyU Faculty of Business”, and cooperated with the University of Waterloo to launch the “University of Waterloo-AMTD Innovation Hub” and “AMTD Waterloo Global Talent Postdoctoral Fellowship”.

Prof. Wilson TONG, Director, AMTD FinTech Centre of PolyU Faculty of Business, said, 95% of FinTech companies say that they are facing a major shortage of FinTech talents, SMEs especially are eager for talents with FinTech skills and knowledge. PolyU has been nurturing the FinTech development, and initiated the first and only professional doctoral programme, Doctor of FinTech (DFinTech), in Hong Kong with the support of AMTD Group, Dr Miranda LOU, Executive Vice President of PolyU, added.

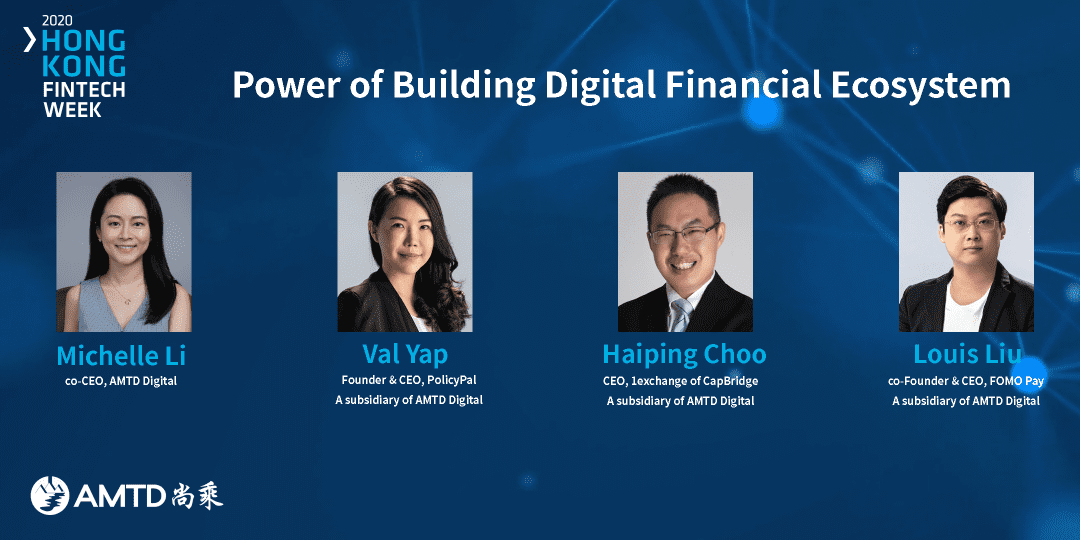

Ms. Michelle Li kickstarted the discussion with a brief introduction of the AMTD Digital. AMTD Digital is the digital arm of AMTD Group, and through AMTD Digital’s “fusion-in” program, talented entrepreneurs in the FinTech space like Val Vap, Haiping Choo and Louis Liu have been integrated into the AMTD SpiderNet ecosystem, while the experiences and expertise they each possess will be fully utilized to build AMTD Digital into a one-stop, comprehensive, cross-market, innovative digital financial services platform.

Ms. Val Yap shared that she believes with AMTD’s abundant resources and a comprehensive ecosystem of SME lending, payment distribution partners and as well as other FinTech entrepreneurs, PolicyPal will be able scale up and realise their vision of being the leading innovator of Asia’s insurance industry.

Mr. Louis Liu also shared the rationale behind joining the AMTD Digital ecosystem. The Covid-19 pandemic has made them realise their clients’ needs of bundled solutions (e.g. credit, financing and insurance) beyond just an unbundled digital payment solution. Therefore once he heard about AMTD Digital’s vision, he knew that joining the AMTD Digital ecosystem would fulfil their clients’ comprehensive needs through its “fusion-in” program.

Mr. Haiping Choo mentioned that AMTD International, as a leading investment bank in the world, encounters lots of good issuers that are not ready for IPO yet, therefore joining the AMTD SpiderNet would boost Capbridge’s issuer pipeline. Haiping Choo also mentioned Capbridge’s interest in working with other professional services firms within the AMTD SpiderNet, such as Nexia TS, which was recently acquired by AMTD.